SUPPORTED PRODUCT

Ready for risk-only product, Risk with saving product or Unitlink product, Life or General insurance.

Don't let you start everything from scratch. We will share our best experiences and knowledge to you. Don't lose market momentum, because long and uncertainty IT project.

Happy and Fun customers, come from insurance companies that have good products, simple and effective internal business processes. That won't happen if you still rely on manual work, silos and rambling business processes.

There's nothing more to tell if your IT Platform doesn't comply with regulations. Compliance to the regulation is an inherent part since the system was first created

Your main backbone to operate your insurance business with efficient and effective technologies. No-more running your business with IT silos and repetitive business process.

Learn More

Integrating health insurance services between healthcare provider, insurance company and corporate clients.

Learn More

.webp)

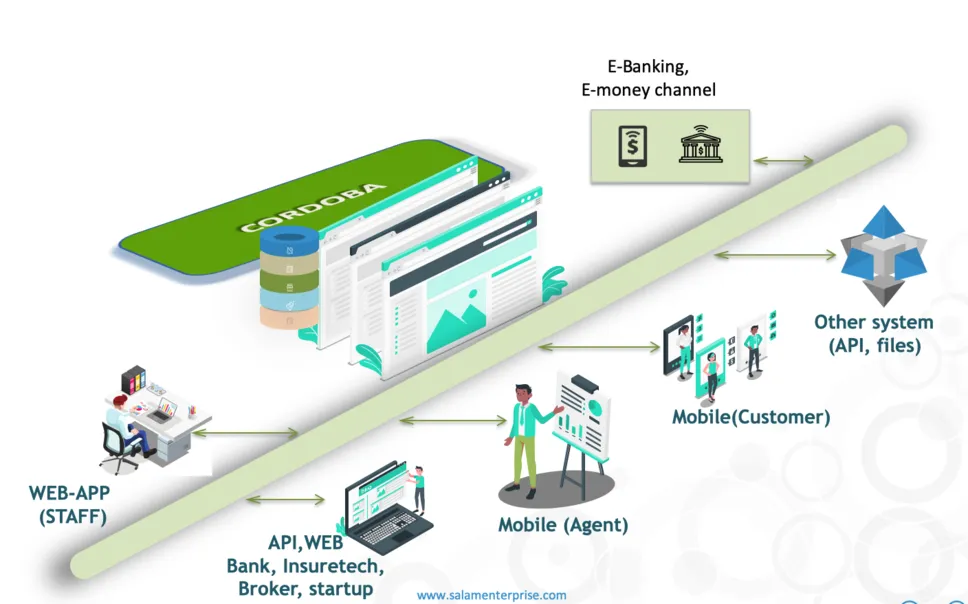

Partner-agent model : Financial Instituion, Community, Startup, Social-organization.

Learn More

Interactive way to deliver human-like insurance services with AI Technology.

Learn MoreYour main backbone to operate your insurance business with efficient and effective technologies.

Ready for risk-only product, Risk with saving product or Unitlink product, Life or General insurance.

Define your target market, Individual client (ritel) or Group client (Corporate) or both Individual and Group clients.

.webp)

Comply with Islamic Law on insurance (Takaful model), splitting of funds, various aqad (contract) model.

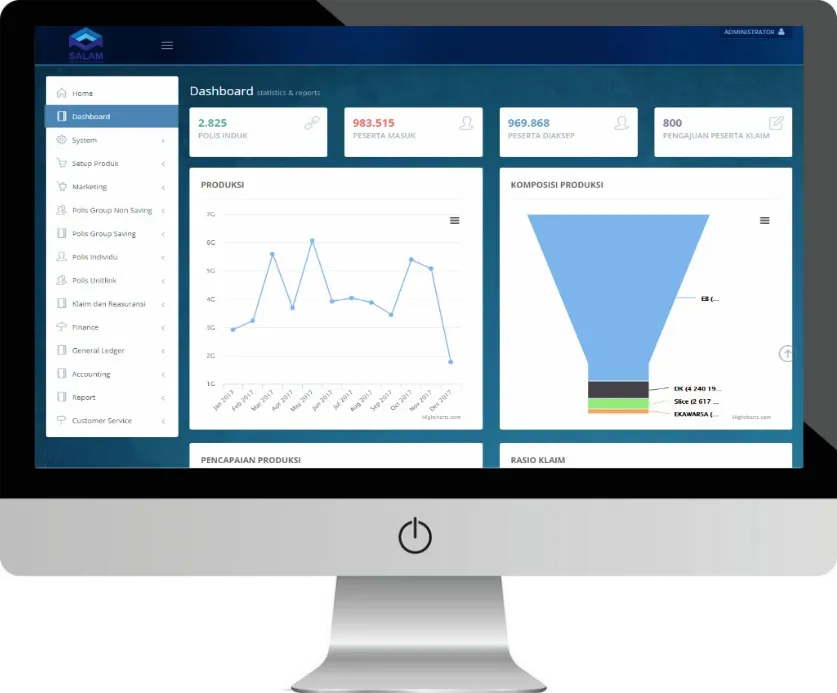

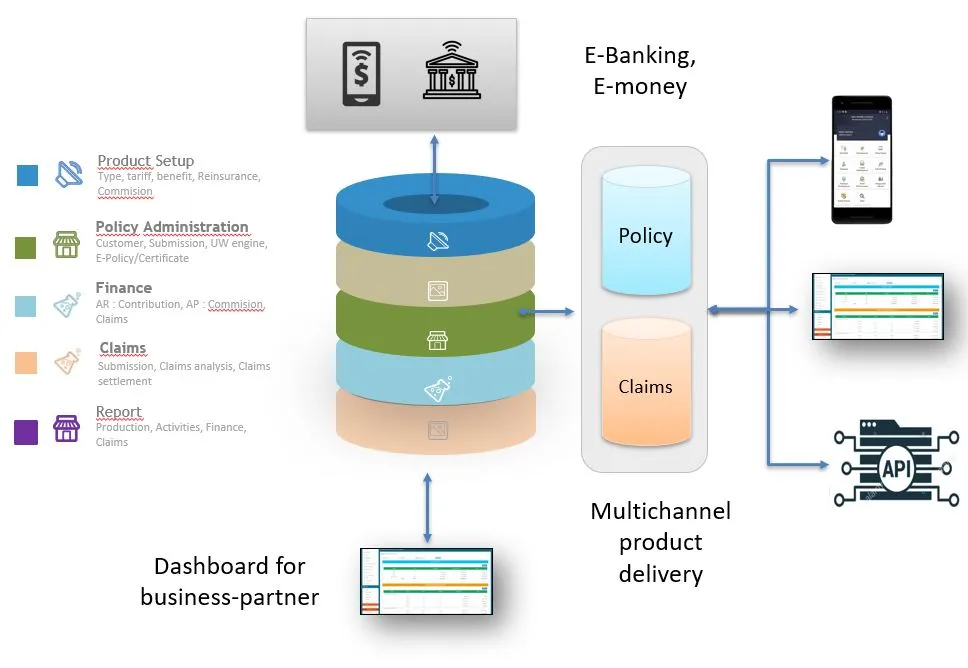

Fullstack of insurance operation modules, from sales illustration, policy administration, finance admin, reinsurance, claims and commission. Data entry do with manual entry model, uploaded from files or integrated with other system through API.

You decide will be whether you choose to deploy it on-premise or in the cloud (AWS, GCP, Azure), with intuitive user-interface and easily integrated to others system.

| Features | Check |

|---|---|

| Channel Management | |

| Product Management | |

| Client Management | |

| Policy Processing | |

| Claims | |

| Reinsurance | |

| Finance | |

| Accounting |

Your digital cockpit to manage, run and flying your sophisticated agency system.

Easy manage insurance agency, track your team activity, monitor sales-funnel, react properly to agency sales problem, deliver best service to agency account with agent smartphone.

Ready to connect to CORDOBA, or other system through API or manually upload data with csv or spreadsheet file.

tracking of sales activity, online sales-quotation, tracking of policy issuance, monitor sales commission, contest monitoring, recruit new agent, live maps agent activities, agent administration, agent promotion-demotion, agent spin-off, comission and others incentive.

Mobile Apps used by agent, agent-leader and Web backend used by internal staff.

Integrating health insurance services between healthcare provider, insurance company and corporate clients.

Easy to choose between running in-house claim processing or through TPA platform mission to make information between insurance-healthcare-TPA transparent to customer.

Ready to connect to CORDOBA, or other system through API or manually upload data with csv or spreadsheet files.

Health insurance sales quotation, standard or tailored-made product setup, policy administation, manage outstanding, manage claims excess, claims settlement and mobile-ready access health insurance membership.

Mobile Apps or web-based used for customer, web-based for corporate client and web-backend for internal insurance/corporate client.

Digitalize your cooperative business with fintech-grade technologies.

Easy to manage cooperative with cashless transaction to create closed-loop economic values.

E-Money tech for cooperative, transfer among members, balance withdraw, open saving product, submit financing, utilities, integration with 3rd-party product providers (consumers goods and others).

.webp)

Mobile Apps for members, web-based technology for staff cooperative.

Ready to connect with Bank, E-money license company, Payment-gateway, 3rd-party product provider.

Interactive way to deliver human-like insurance services with AI Technology.

Never-sleep customer service, smart agent to serve your customer for product needsr for product need.

Multi channel conversation WA Telegram or web-chat, deliver e-policy, user-defined conversation flow.

on-premises model or cloud model (AWS, GCP, Azure), with intuitive user-interface and easily integrated to others system.

API with CORDOBA or other insurance system.

Our Security

PT AMA Salam Indonesia is committed to implement an Information Security Management System (ISMS) by:

Providing adequate resources to enable the effective and efficient implementation of the company's ISMS.

Developing and maintaining a business continuity plan for the company.

Developing and maintaining a risk management process related to the company's information security.

Ensuring that this ISMS policy is understood and implemented by all work units, reviewed and continually developed.

Establishing, implementing, maintaining, and continually improving the ISMS in the environment of PT AMA Salam Indonesia.

Maintaining the confidentiality, integrity, and availability of all company-owned information assets.

Ensuring that the ISMS supports the business and operational needs of the company.

Complying with all applicable laws, regulations, and other requirements.

Interested in our Product or just want to know more detail? write message down below.